Economic Development

Welcome to Our Community

Are you considering relocating to Brandon? If so, contact the Town Office or stop by. The Office of Economic Development works with the Downtown Brandon Alliance (DBA), Brandon’s “Designated Downtown organization.”

Brandon is home to an active business community offering a wide spectrum of products and services combined with excellent customer service.

We are proud of our community and optimistic about it’s future. You will find us cooperative, proactive and dedicated to serving you as citizens of this community.

Quick Links

Vermont Downtown Action Team

Here is the presentation from the V-DAT team, November 2013 (with some audio difficulties). Stick with it — its a great presentation despite the technical problems.

Tax Stabilization

The Town of Brandon is committed to sustainable commercial growth and uses tax stabilization as a tool to reach that goal. The gains in grand list value and investment in new and existing buildings will naturally lead to more economic stability for residents and tax payers, providing services, goods, and jobs.

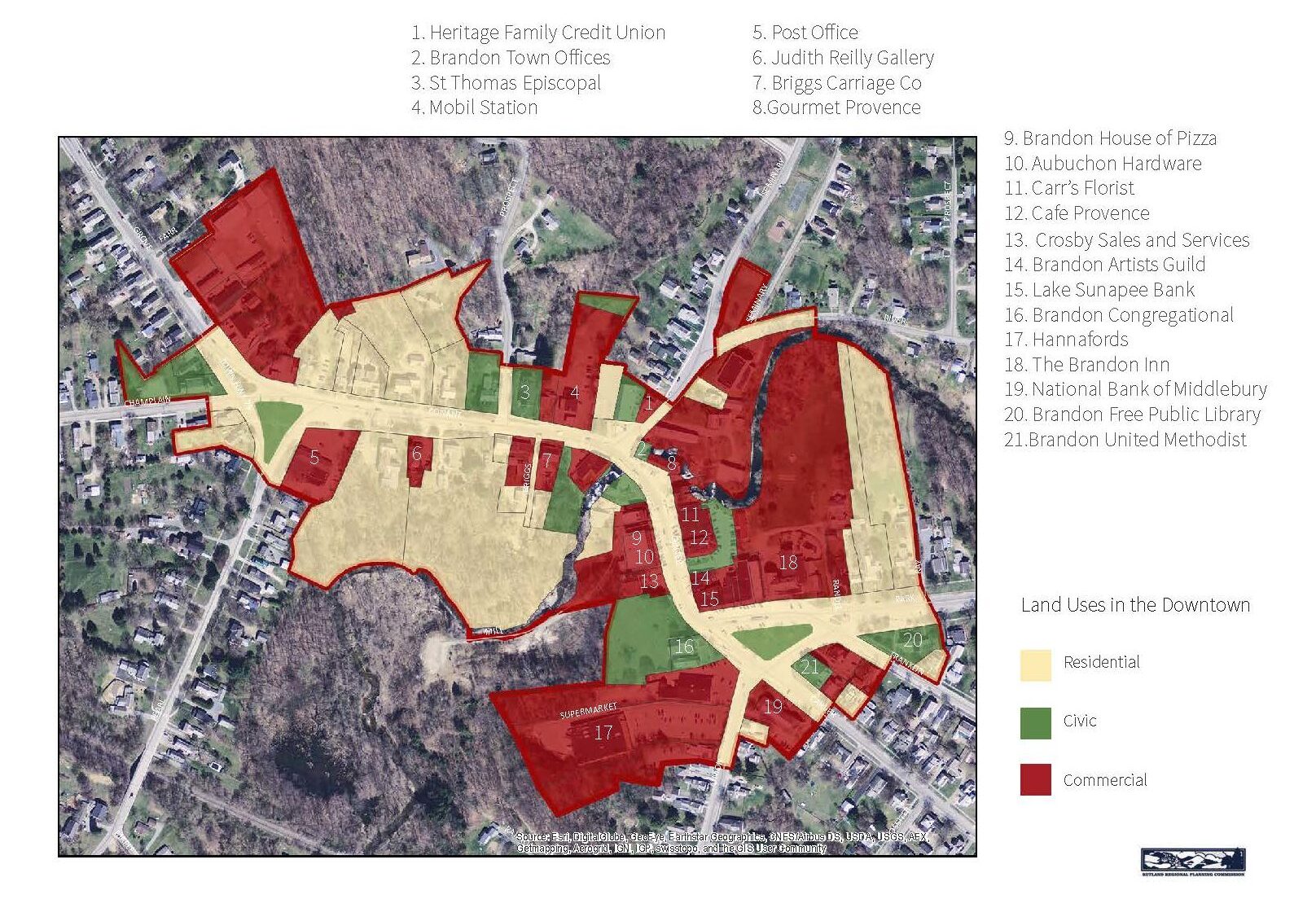

Downtown Boundary Map